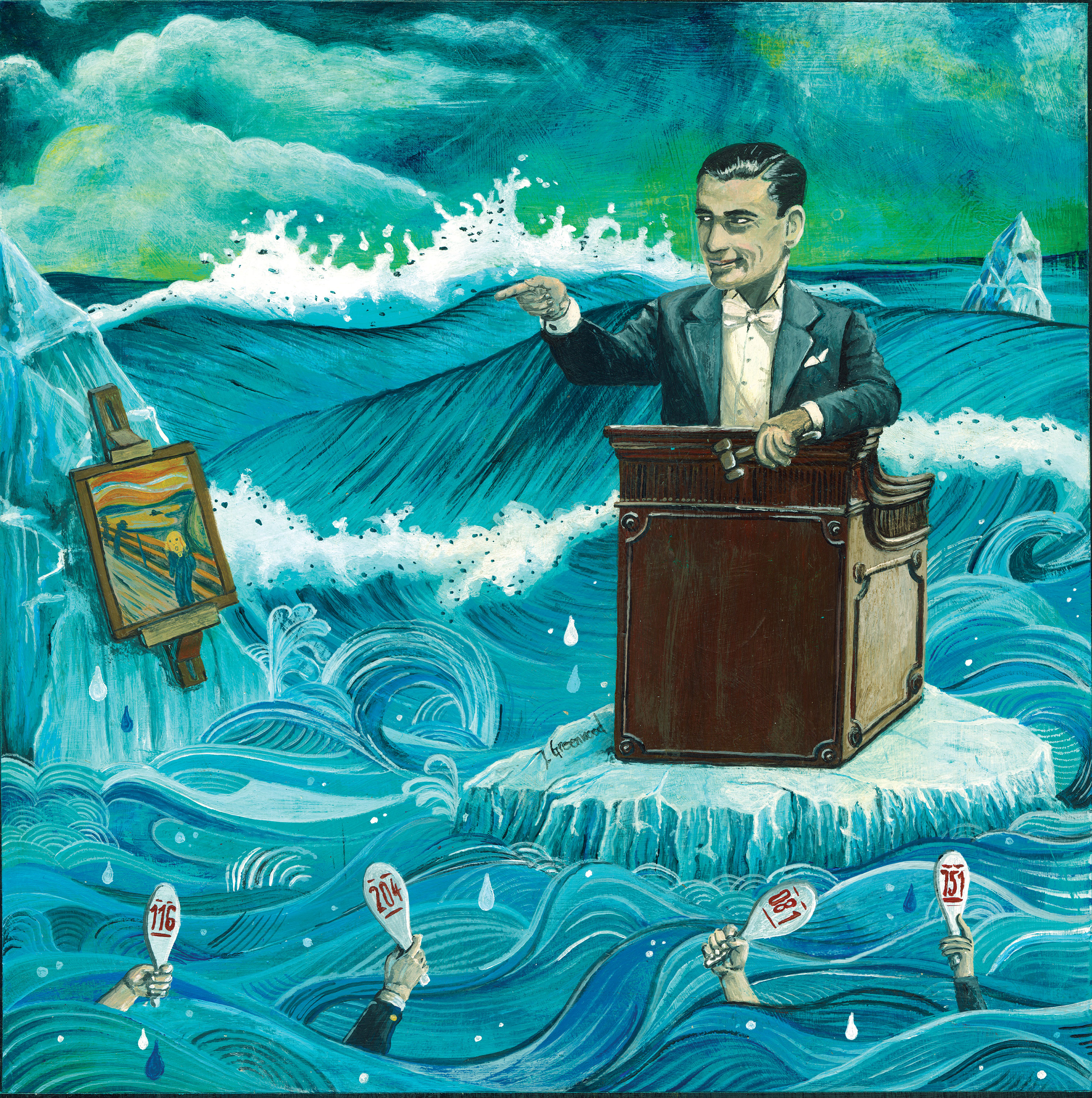

04 Aug Collector's Notebook: Fine Art and Taxes

For “Catherine” the moment was bittersweet. As her mother’s last will and testament were being read, the surviving middle-aged daughter discovered that, much to her surprise, she’d just inherited several prized artworks from her parents’ personal collection.

For as long as she could remember, Catherine*, a lone child, had grown up around paintings and sculpture. She watched her parents purchase works from living artists they knew, from galleries they visited while traveling, and at auction. Some were even created by fairly well-known names in Western and American art.

Now, suddenly, Catherine was confronted with something that few offspring are prepared for: the potential financial implications of owning and inheriting fine art. Should she hold on to the works as keepsakes and possible investments or sell them? Should she give them to a museum, put them up at auction or make a donation to a favorite charitable organization and try to claim a tax deduction?

Today, with the parents of baby boomers reaching the ends of their lives, and with older boomers themselves entering their golden years, art collections large and small have begun transferring hands generationally in a wave that experts say is unprecedented.

Any fan of PBS’s “Antiques Roadshow” knows the vicarious thrill that comes with the dream that a taken-for-granted piece of art is actually a winning lottery ticket just waiting to be cashed in. For most amateur art collectors, however, the reality is often less thrilling and far more complicated, according to two experts who deal with this sort of thing every day.

Alan Breus, a Southern Californian, is regarded as one of the top estate appraisers in the country. He’s spent decades advising prominent individuals, universities, charities, and brokerage and accounting firms about the potential value of collectible items ranging from fine art to rare documents, books, documentary films and many categories in-between.

Robert J. Koenke, meanwhile, is a professional appraiser based in Maryland. The former publisher of Wildlife Art magazine has, in more recent years, assisted art collectors across the country with putting values on their art.

“Individual pieces of art and accumulated collections are very personal and very specific to the people who build them,” Breus says. “They come to reflect who a person is and are tied in some ways to their identity. It’s what they do in their free time and many of their friends, similarly, might also be collectors,” Breus says. “Trouble happens when people take their collections to heart while their kids couldn’t care less because the art doesn’t hold the same meaning. That’s why it’s important for the people who built the collection, if they care what happens to it after they’re gone, to ensure the transfer doesn’t cause problems.”

Tax implications for collecting art are established by fair market value, Breus says. Fair market value is the price that a willing buyer is willing to pay to a willing seller, neither being pressured to act. Established fair market value is based on records of sales for individual pieces or pieces created by comparable artists of comparable quality and professional stature.

When it comes to artworks that come into possession from inheritance, dynamic tension can exist. In order to pay less estate taxes, a benefactor will want to have a work of inherited art set at the lowest level possible while the Internal Revenue Service, acting on behalf of Uncle Sam and U.S. taxpayers, will likely err on the higher side of an artwork’s established fair market value.

This is where the expertise of an appraiser in establishing a defensible baseline comes into play. Breus and Koenke can’t count the number of times that collectors trying to divest pieces have been disappointed, their expectations set by extrapolating prices based upon dealer or retail prices. While some artworks do indeed accrue market value over time, there is no guarantee that a price paid for a painting or sculpture yesterday or years ago will fetch the same amount today.

Like all other commercial liquid assets, art markets tend to ebb and flow, influenced by overall economic conditions, demand for certain artists, quality and number of pieces that are available, perception of artists created by the media, and other factors.

The hassle of having to navigate these sometimes tricky tax waters, Breus says, can transform a moment of joy into a perceived burden, which is why enlisting licensed professionals is important. The downside is that seeking guidance comes with its own expense, but it can buy peace of mind.

* Editor’s Note: Catherine is not a real person. This article is intended to provide general information, not legal advice of any kind, and is no substitute for the reader seeking counsel from established professionals.

No Comments